The Greatest Guide To Best Broker For Forex Trading

The Greatest Guide To Best Broker For Forex Trading

Blog Article

Some Known Details About Best Broker For Forex Trading

Table of ContentsRumored Buzz on Best Broker For Forex TradingOur Best Broker For Forex Trading DiariesA Biased View of Best Broker For Forex TradingNot known Details About Best Broker For Forex Trading The Facts About Best Broker For Forex Trading Uncovered

Because Foreign exchange markets have such a huge spread and are used by a huge variety of individuals, they use high liquidity in contrast with various other markets. The Foreign exchange trading market is continuously running, and many thanks to contemporary innovation, is obtainable from anywhere. Hence, liquidity refers to the reality that any individual can get or offer with an easy click of a button.Therefore, there is constantly a potential retailer waiting to buy or sell making Forex a fluid market. Price volatility is among the most essential factors that assist pick the next trading action. For short-term Foreign exchange investors, cost volatility is critical, because it shows the per hour changes in a possession's value.

For long-term financiers when they trade Forex, the rate volatility of the market is also essential. This is why they take into consideration a "purchase and hold" method might offer higher incomes after an extended period. An additional significant advantage of Forex is hedging that can be put on your trading account. This is an effective method that aids either remove or lower their danger of losses.

Best Broker For Forex Trading Things To Know Before You Get This

Depending upon the moment and initiative, traders can be divided right into classifications according to their trading style. A few of them are the following: Forex trading can be successfully applied in any one of the methods above. Moreover, as a result of the Forex market's fantastic volume and its high liquidity, it's feasible to enter or leave the marketplace any type of time.

Forex trading is a decentralized innovation that operates with no main management. An international Forex broker need to conform with the standards that are specified by the Foreign exchange regulator.

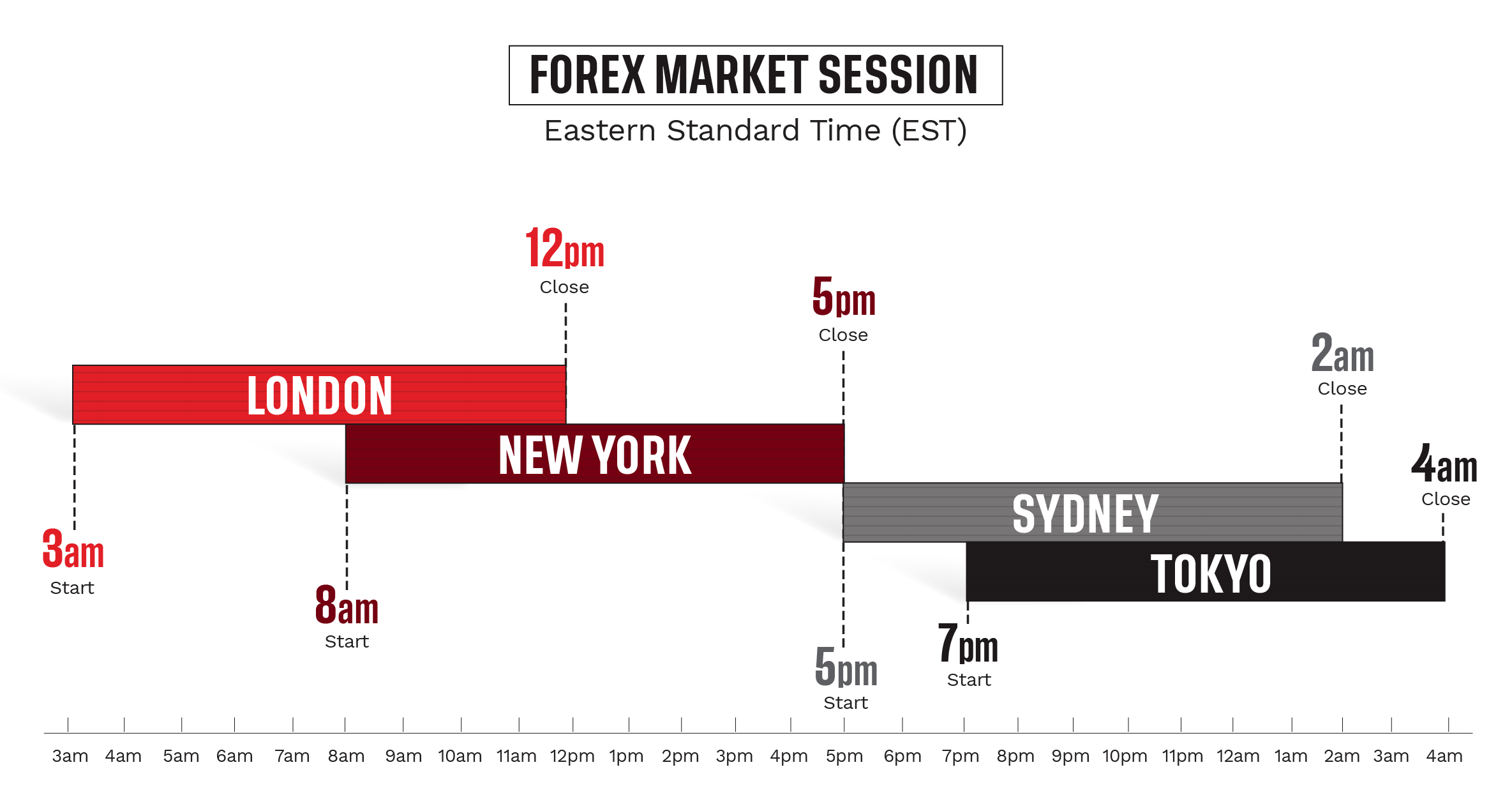

Thus, all the deals can be made from anywhere, and considering that it is open 24-hour a day, it can also be done at any time of the day. For example, if a financier lies in Europe, he can trade during North America hours and keep track of the steps of the one money he has an interest in (Best Broker For Forex Trading).

The Single Strategy To Use For Best Broker For Forex Trading

A lot of Foreign exchange brokers can use an extremely reduced spread and minimize or even eliminate the trader's expenses. Financiers that pick the Forex market can improve their earnings by avoiding charges from exchanges, down payments, and other trading tasks which have additional retail transaction costs in the supply market.

It gives the option to get in the market with a tiny spending plan check it out and trade with high-value money. Some investors may not accomplish the needs of high leverage at the end of the deal.

Forex trading may have trading terms to protect the market individuals, yet there is the threat that somebody might not appreciate the agreed contract. The Forex market functions 24 hours without stopping.

When retail traders describe cost volatility in Forex, they suggest just how huge the upswings and drop-offs of a money pair are for a particular duration. The bigger those ups and downs are, the higher the rate volatility - Best Broker For Forex Trading. Those large changes can stimulate a sense of unpredictability, and occasionally investors consider them as a chance for high earnings.

A Biased View of Best Broker For Forex Trading

Some of the most unpredictable currency sets are thought about to be the following: The Foreign exchange market offers a great deal of advantages to any why not try here Foreign exchange investor. Once having determined to trade on foreign exchange, both skilled and newbies learn the facts here now require to define their financial strategy and obtain familiar with the terms.

The material of this article shows the author's point of view and does not necessarily show the official placement of LiteFinance broker. The material published on this page is attended to informative functions just and need to not be thought about as the arrangement of investment suggestions for the purposes of Directive 2014/65/EU. According to copyright law, this write-up is taken into consideration intellectual property, which includes a prohibition on duplicating and dispersing it without approval.

If your business operates worldwide, it is essential to understand just how the worth of the U.S. dollar, about various other currencies, can significantly impact the cost of goods for united state importers and exporters.

Some Known Incorrect Statements About Best Broker For Forex Trading

In the early 19th century, money exchange was a major part of the procedures of Alex. Brown & Sons, the very first financial investment bank in the United States. The Bretton Woods Arrangement in 1944 called for money to be pegged to the United States buck, which remained in turn fixed to the cost of gold.

Report this page